south dakota sales tax filing

General Office Apostille Authentication Notary. Ad New State Sales Tax Registration.

Millions Of Businesses Small Medium Are Withheld From An Employee S Paycheck A Portion Is An Expense To T Sales Tax Goods And Service Tax Goods And Services

If the due date falls on a weekend or holiday then your sales tax filing is generally due.

. South Dakotas sales and use tax rate is 45 percent. Learn what you need to file pay and find information on taxes for the general public. Tax calculation filing of tax returns and tax payments.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. Risk Free for 60 Days. How to Get Help Filing a South Dakota Sales Tax Return.

Filing Fees Effective July 1 2016 This website provides a complete list of all fees collected by the Secretary of States office. If a business sells taxable tangible. The South Dakota Department of Revenue administers these taxes.

File sales tax faster with Avalara Returns for Small Business. South Dakota requires businesses to file sales tax returns and submit sales tax payments online. Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery.

Transactions file your sales tax returns and remit payment of this tax on your behalf to the SST states. Filing a South Dakota sales tax return is a two-step process comprised of submitting the required sales data filing a return and remitting the collected tax dollars if any to the South Dakota. Department of Revenue Remittance Center PO Box 5055 Sioux Falls SD 57117-5055 Please note that if you file your South Dakota sales taxes by mail it.

South Dakota Sales Tax Filing Address. If you are stuck or have questions you can contact the state of South Dakota directly by telephone at 605 773-3311. In South Dakota you will be required to file and remit sales tax either at the states discretion and this can be monthly bimonthly quarterly or semi-annually.

Our tax preparers will ensure that your tax returns are complete accurate and on time. The process of filing sales tax in South Dakota consists of three primary steps. The state also has several special taxes and local jurisdiction taxes at the city and county levels.

Ad Sovos managed services makes sales tax filing easier for online sellers and merchants. In order to file sales. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

South Dakota sales tax returns are due on the 20th day of the month following the reporting period. Depending on the volume of sales taxes you collect and the status of your sales tax account with South Dakota you may be required to file sales tax returns on a monthly semi-monthly. Model 1 If you anticipate using a CSP please contact them prior to registering the.

South Dakota Sales Tax information registration support. File the South Dakota Sales Tax Return You will do this with the South Dakota.

Get Ready To Pay Sales Tax On Amazon

Sales Use Tax South Dakota Department Of Revenue

E Commerce And Sales Tax Youtube Sales Tax Commerce Ecommerce

June 2018 Us Supreme Court Introduced A New Economic Nexus Test To Determine If Out Of State Online Retailers Are Responsible Fo Wayfair Retail Floor Plans

Sales Tax After Wayfair V South Dakota The Legalpreneur Product Based Business Business Blog Small Business Tips

Pin On Blog Tips For Small Businesses

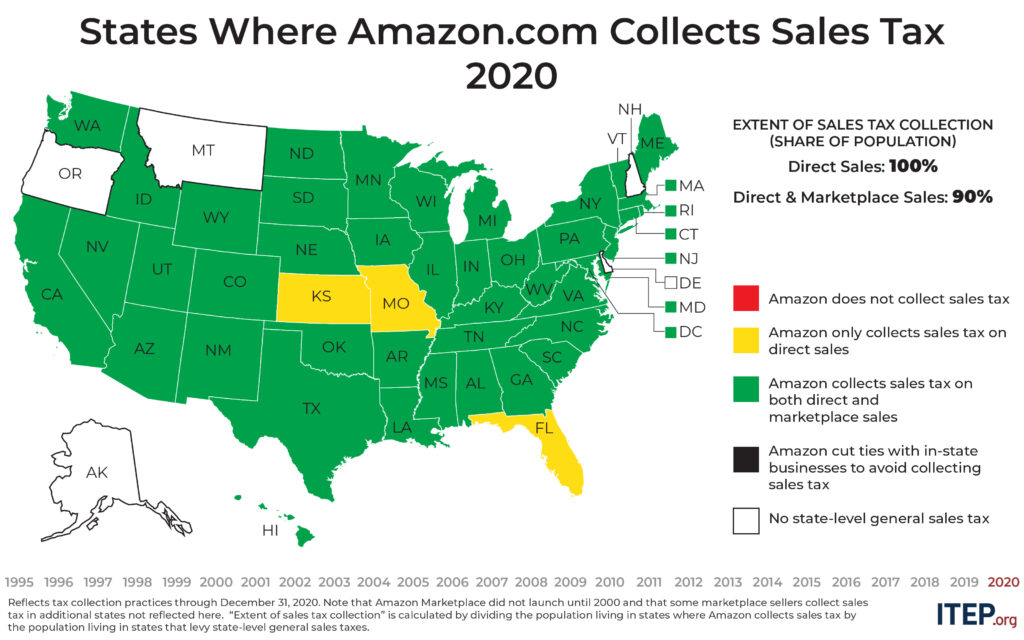

A Visual History Of Sales Tax Collection At Amazon Com Itep

Sales Use Tax South Dakota Department Of Revenue

District Of Columbia Sales Tax Small Business Guide Truic

Form Sd Vehicle Title Transfer

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Sales Tax After Wayfair V South Dakota The Legalpreneur Small Business Tips Online Business Product Based Business

Income Tax Filings In These Counties Were Audited At A Lower Rate Than The Nation As A Whole Infographic Map Places In America Native American Reservation

Sales Tax Filing For Your Small Business Happy Human Pacifier Have You Started A Home Business During Lockdown If You Re Sellin Filing Taxes Sales Tax Tax

Sales Use Tax South Dakota Department Of Revenue

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax State Tax